Phonecast sheds light on the College’s endowment and how to sustain it

October 17, 2024 — President Anne F. Harris and Vice President of Finance and Chief Financial Officer Germaine Gross joined more than 1,300 alumni on a Sept. 9 Phonecast, moderated by Alumni Council member Grisel Hernandez ’17, to discuss the ins-and-outs of Grinnell College’s endowment.

The hour-long conversation began with an overview of the College’s annual budget, defined how the endowment works, sought to address misconceptions about the endowment, and concluded with a wide-ranging question and answer period open to everyone on the call.

Since coming to Grinnell, Harris has learned the endowment “has a life of its own” in the minds of alumni and students, which has a cultural effect on Grinnell College.

“I like to think of the endowment as dynamic; it’s truly things in motion,” Harris said.

An endowment cash flow chart compares the giving to the endowment amount with the endowment distribution figures during last fiscal year.

An endowment cash flow chart compares the giving to the endowment amount with the endowment distribution figures during last fiscal year.

Harris stressed that the College uses the annual payout from Grinnell’s $2.5 billion endowment for two things: “action” (such as staff, faculty, and student worker salaries, programming, maintaining the physical plant) and “access” – the $75 million in student financial aid that will be distributed this year.

President Anne F. Harris

President Anne F. Harris

While the endowment makes so much of what happens at Grinnell possible, Harris and Gross noted that Grinnell’s annual operating budget is the most dependent on the annual endowment distribution among its peer institutions. At the same time, Grinnell’s student revenue (tuition, fees, room and board less financial aid awarded) and annual philanthropy are also some of the lowest in that group. Gross and Harris both clarified that student revenue is immediately spent to support the activities of the College each year and is not part of the endowment.

The Q&A portion of the call covered a wide range of topics including whether the College could increase its enrollment to boost student revenue and why the endowment represents such a large portion of Grinnell’s budget each year.

For the first question, Gross said the College is assessing many options. Enrollment increases are hampered by residence hall and academic buildings capacity. Any meaningful enrollment increase would necessitate significant investment in both human and physical infrastructure.

The latter question comes down to the amount of financial aid the College awards each year, making it one of the most generous colleges among its peers. This includes the College’s no-loan initiative, which provides about $5 million each year in scholarships to students.

Being able to keep and fulfill its promises around affordability and access are the reasons the Board of Trustees has tasked the College with reducing the current market value component of the endowment payout from 4.5% to 4% by fiscal year 2029. To that end, the College has launched its Reducing Endowment Dependence (RED) Initiative. RED aims to ease pressure on the endowment by finding $5 million in cost savings and revenues by FY 2029 and another $5 million by FY 2034. Gross said that College staff have already identified $3 million in cost savings that will be implemented with minimal impact on the College as a whole.

Nathan Williams ’03 asked if Harris and Gross could elaborate on the financial obstacles that might lie ahead for the College. In response, Harris said that the College is thinking about everything from lower market returns and economic downturns to legislative efforts to tax endowments. “When you’re as endowment dependent as we are, you think of the phrase ‘the bigger they are, the harder they fall,’” Harris said.

Germaine Gross

Germaine Gross

While the endowment’s holdings aren’t comparable to an individual retirement account, Gross explained, that College’s annual investment return over the last decade has been 8.6%, which falls in the median quartile of endowment investment returns among peers. While there was enthusiasm for that return on the call, alumni did ask about the aggressiveness of the College’s investment strategy. “The more endowment dependent we are, the more careful and conservative we have to be in our investment,” Harris said, something the College’s Investment Office and the Board of Trustees’ Exit 182 Group grapples with all the time.

One way to ensure the endowment’s long-term sustainability is to replenish the endowment not solely through market returns, but through philanthropy and alumni giving. Maggie Banning ’82, a class fund director from Indianapolis, asked about the number of alums supporting the College financially overall and how alumni gifts figure into the budget each year. Harris said that less than a quarter of alumni (23 percent) contribute financially to the College, and Gross mentioned that alumni contributions to the unrestricted Pioneer Fund (which supports the annual budget) amounted to around $1.6 million last year.

Those figures prompted Austin Kessler ’76 to ask how the College would communicate this need to alumni. “Everybody thinks ‘Grinnell has this huge endowment, my giving really isn’t that important,’” Kessler said. “The size of the endowment seems to cut both ways. It gives us a lot of flexibility and allows us to do things we couldn’t do otherwise, but it does have the effect of suppressing philanthropy for the College.”

The importance of philanthropic giving will continue to be emphasized, Harris noted, as part of an effort to bolster the philanthropic component of ensuring the endowment’s sustainability.

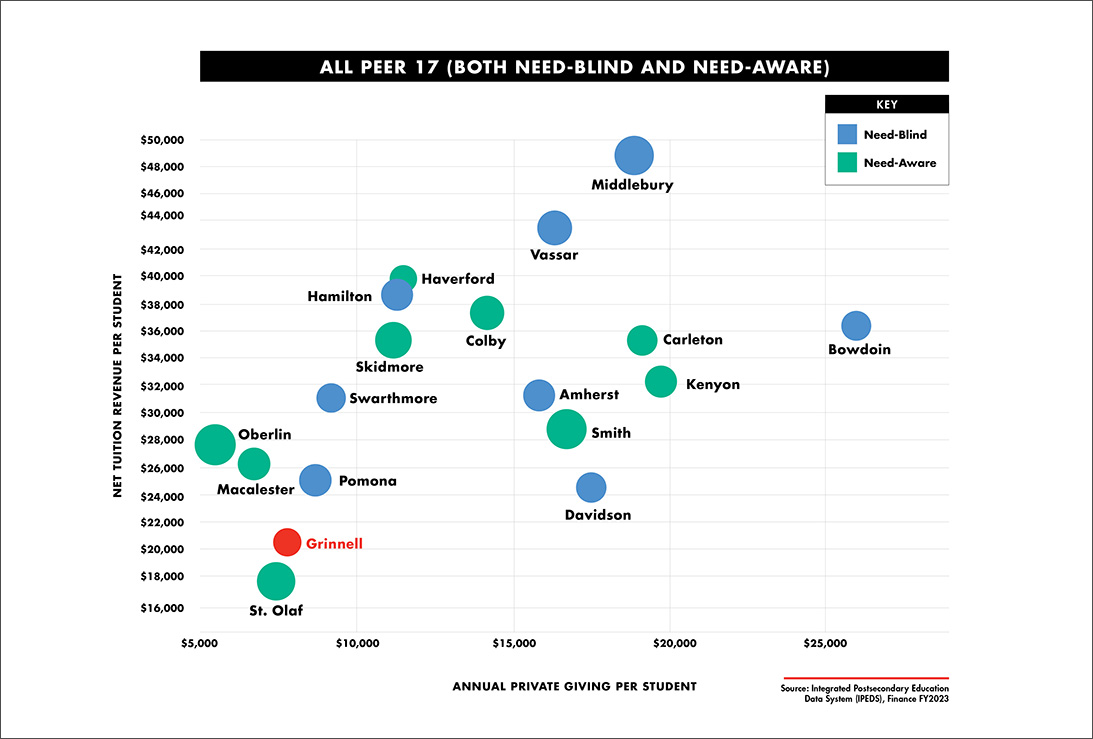

This chart compares the net tuition revenue per student with average fundraising figures for Grinnell and other peer colleges. Clicking the image will allow you to see the graphic in full size.

This chart compares the net tuition revenue per student with average fundraising figures for Grinnell and other peer colleges. Clicking the image will allow you to see the graphic in full size.

“I see philanthropy as a relatively unflexed muscle at Grinnell – it’s there, but it’s about the path into the philanthropy and the endowment that we need to make clear,” Harris said “…Many schools with larger endowments have more philanthropy than Grinnell.”

In an interview after the Phonecast, Hernandez said it was interesting to learn about the College’s approach to endowment management and their strategies for encouraging philanthropy.

Grisel Hernandez ’17

Grisel Hernandez ’17

“I moderated the Phonecast to gain insights on the College’s endowment management strategies and alumni’s key concerns, especially given the challenging donation and market environment,” Hernandez said. “I hope this is just one of many future conversations between the College and its alumni. Understanding our current position and what needs to be done – by both the administration and the community – will help us work toward ensuring the College’s long-term sustainability. I believe this is a goal we can get behind.”

Near the end of the call, Harris said she recently received an email from a young alumna who had been the recipient of an Elsie M. Stouffer 1924 Fellowship, which gave this recent graduate a “life changing” opportunity.

“It’s so moving to me that there is an alum who – without knowing this student – said ‘I want you and students like you to have this opportunity in perpetuity,’” Harris said. When alumni gifts are directed to Grinnell, “it’s for the students and what we make possible for them.”

— by Joe Engleman ’14